DSI is Accountability Integrity Passionability Selfless Service Positivity

A NEW MEXICO BUSINESS DEDICATED TO BUILDING STRONG PARTNERSHIPS AND CONTRIBUTING TO THE SUCCESSES OF THE COMMUNITIES WE SERVE.

DSI solves technology pain points through customized office technology & IT services in New Mexico. Print Imaging. Document Handling. Document Management. IT Infrastructure & Voice Audio/Visual. Security Systems.

Let us know what technology means to you, and there’s a good chance we can help.

Customized Office Technology & IT Services in New Mexico

Office Technology & Managed Print Services

Managed IT Services

& Phone Solutions

Video Security Systems

Audio/Visual Equipment

BOOST YOUR PRODUCTIVITY AND REDUCE COSTS WITH DSI

DSI is your trusted local office technology partner, providing our New Mexico and El Paso, TX businesses with access to the best printers, IT services, security systems, audio/visual equipment, software, and support in the market today.

Our foremost goal is not to sell to you but to support our local economy by providing the advanced solutions and top-tier support our community needs to gain a competitive edge.

Reduce Printing Costs

Lower your printing expenses by utilizing our energy-efficient suite of printers and print tracking and control solutions. DSI's innovative technology allows you to gain a comprehensive understanding of your printing expenditures and identify potential areas for cost reduction.

Improve Security

DSI ensures the safety of your investments by providing customized solutions that safeguard your most valuable physical and digital assets from unauthorized access and theft.

Enhance Communication

As business, healthcare, and educational environments change, DSI offers comprehensive solutions to enhance communication and collaboration. Our offerings include interactive whiteboard screens that facilitate collaborative hybrid meetings and VoIP phone systems that enable you to access your desk phone from any location worldwide.

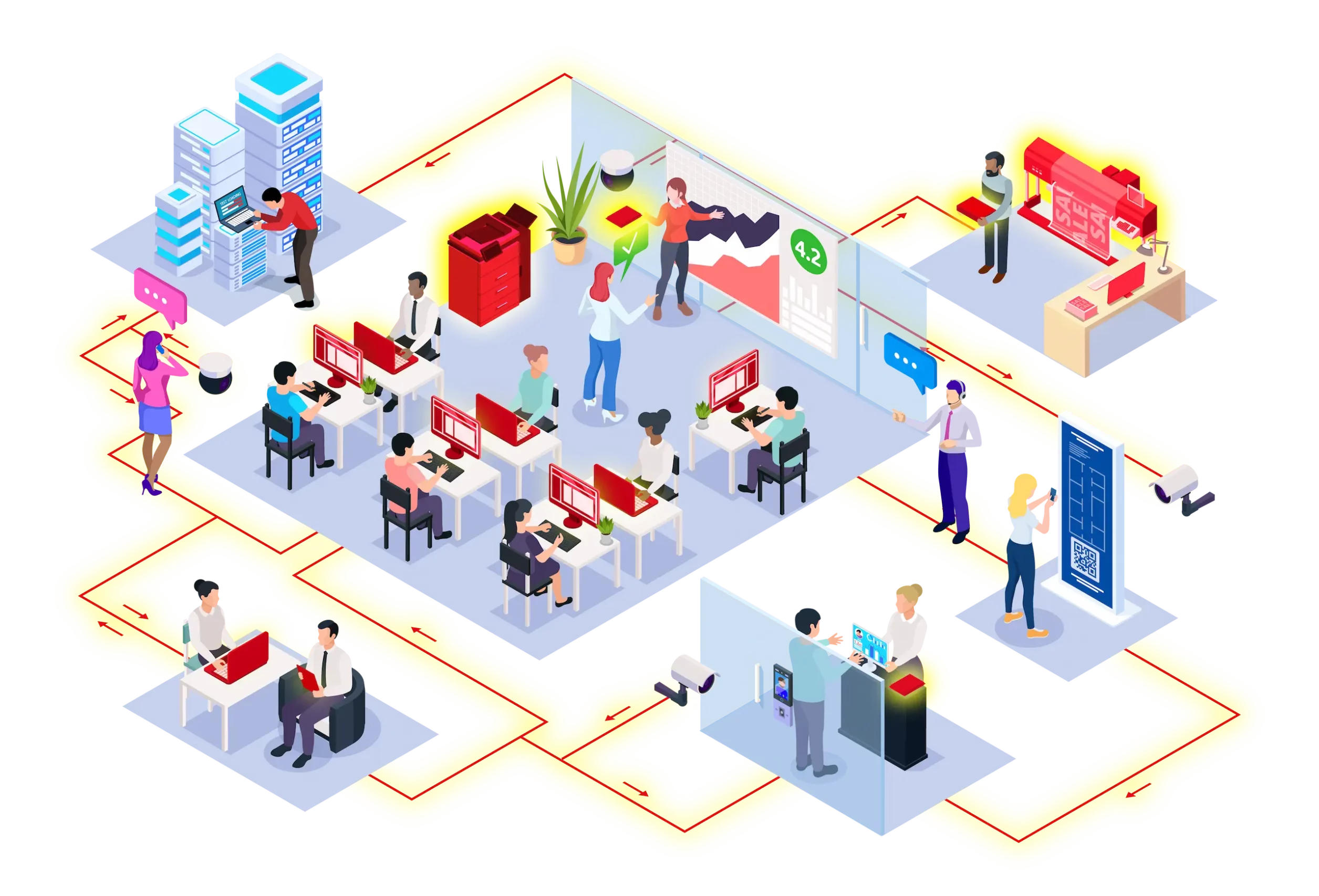

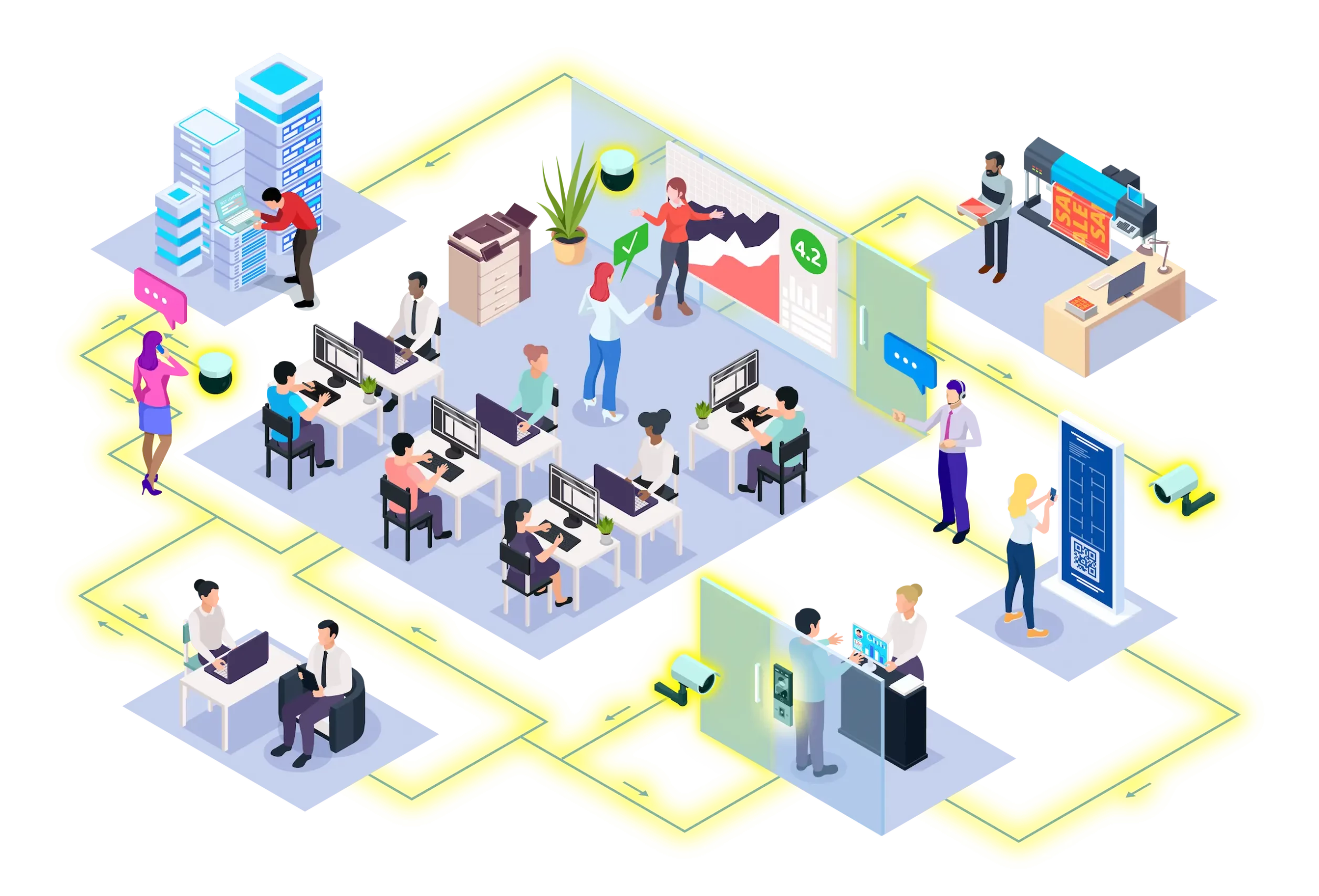

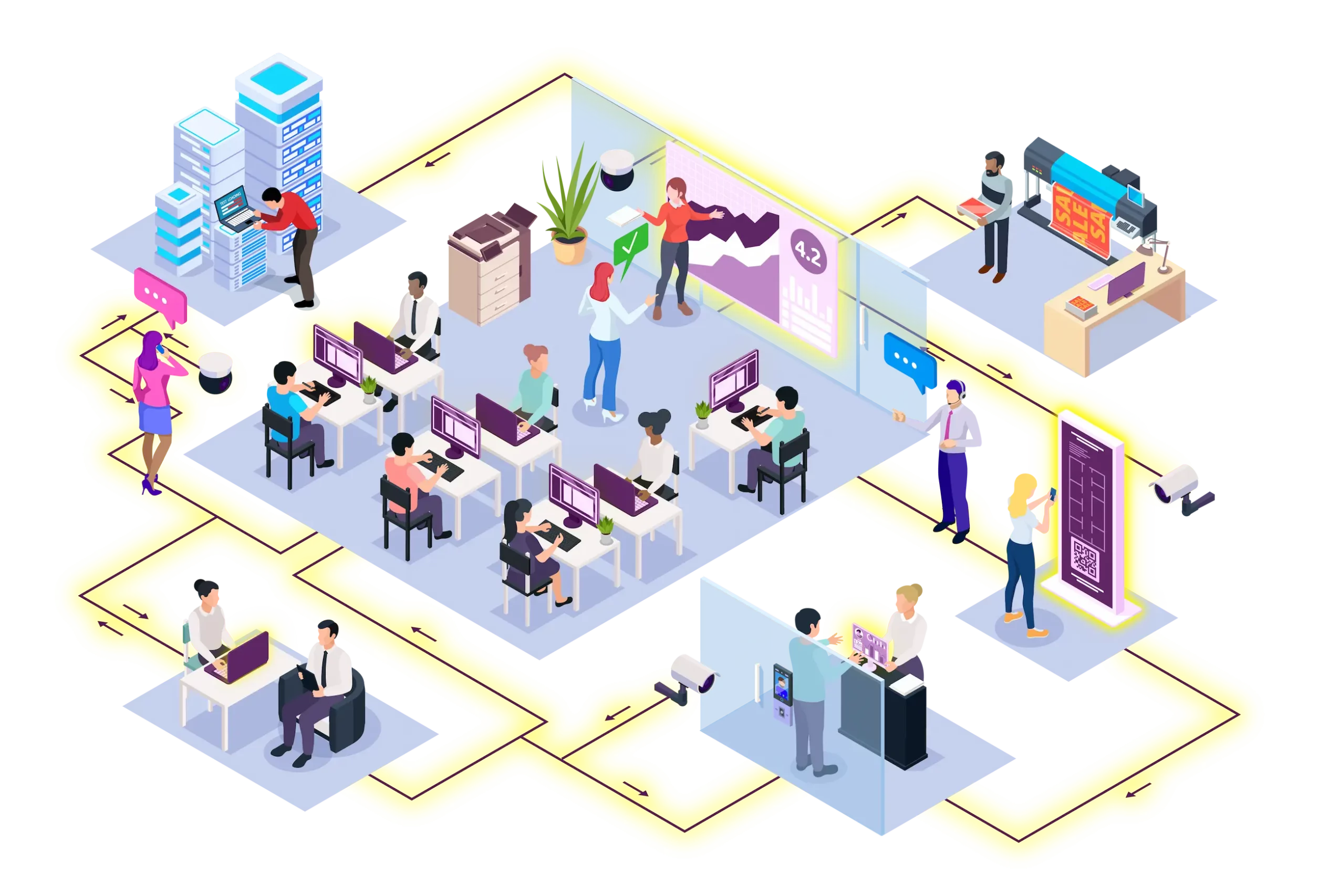

DSI: Full Office Technology Solution

What does your current business environment look like? What works well? What would you like to improve? DSI works with your business to assess your workflows, identifying and mitigating pain points through our suite of technology solutions and support.

Explore our selection of offerings in the diagram below:

Office Technology & Managed Print Services

Office Technology & Managed Print Services

Office Technology & Managed Print Services

Office Technology & Managed Print Services DSI helps small businesses, enterprises, and institutions save on document costs by deploying industry-leading imaging technology. Our print hardware solutions empower our customers to use fewer consumables, print higher-quality documents, and communicate seamlessly in both digital and paper formats.

Managed IT Services & Phone Solutions

Managed IT Services & Phone Solutions

Managed IT Services & Phone Solutions

Managed IT Services & Phone Solutions Stop worrying about IT issues and focus more on what you do best!

Our exclusive stack of Managed IT Services lets you select the technology support you need for one low, predictable monthly amount. Think of us as an extension to your existing IT team, or let us manage your entire IT infrastructure for you.

Video Security Systems

Video Security Systems

Video Security Systems

Video Security Systems Deploy cutting-edge video surveillance technology with DSI!

DSI Security conducts thorough assessments of your business environment to develop a customized security framework that aligns with your establishment’s specific needs. Additionally, we possess the expertise to seamlessly integrate new technological advancements into your existing security infrastructure.

Audio/Visual Equipment

Audio/Visual Equipment

Audio/Visual Equipment

Audio/Visual Equipment Say goodbye to the pitfalls of ineffective communication. Let DSI improve your target engagement!

We walk with you every step of the way, from selecting the most suitable digital display solution for your specific environment and budget to providing white-glove installation, comprehensive training, and ongoing support.

DSI Audio/Visual Solutions is dedicated to equipping your business with the tools it needs to gain a competitive advantage.

WHO WE ARE

A New Mexico business dedicated to contributing to the successes of the communities we serve.

DSI stands for Document Solutions, Inc.

Which is an apt description of the value that has driven our company to success for more than 25 years.

We are a family-owned and operated business with seven offices covering the entirety of New Mexico and an additional regional office in El Paso, Texas. DSI helps medical, academic, and government institutions respond to changing technological needs while improving the efficiency of imaging and networking processes.

We are not here to sell printers or network hardware to you. We are here to be your trusted advisor in developing and implementing business infrastructure to meet your organization’s needs.

CLIENT TESTIMONIALS

Charline is the best tech Ive encountered in the 18yrs I have worked with my company.

Rate our technician overall.

I am very satisfied with DSI repair service. Richard Hale is a superior service tech. If I have a problem with anything I will contact Richard.

Remove me from further emails like this. (If yes, please tell us why.)

As always very efficient and prompt

Rate our dispatch overall. (Ease of placing a service call, professionalism, etc.)

I like the new email to keep us informed

Communication to keep me informed.

Very friendly and explained the problem

Rate our technician overall.

ExcellentBased on 55 reviews

Desiree Cortez2024-02-14The crew at DSI is the bomb. I've had the pleasure of working with Ben. He is now creating a team of awesomeness. I just met Gen and Courtney and am excited to work with them moving forward and in hopes to continue our business relationship for years to come. I was visited today by the customer experience rep and he was an absolute delight. David was very personable and i enjoyed our talk. Looking forward to attending the March Madness Event if everything goes well.

Desiree Cortez2024-02-14The crew at DSI is the bomb. I've had the pleasure of working with Ben. He is now creating a team of awesomeness. I just met Gen and Courtney and am excited to work with them moving forward and in hopes to continue our business relationship for years to come. I was visited today by the customer experience rep and he was an absolute delight. David was very personable and i enjoyed our talk. Looking forward to attending the March Madness Event if everything goes well. Juan Ruiz2024-02-14Everything was perfect. David Martinez was excellent at explaining everything we needed to know. Great Service

Juan Ruiz2024-02-14Everything was perfect. David Martinez was excellent at explaining everything we needed to know. Great Service Eileen Watson2024-02-06

Eileen Watson2024-02-06 Avenelle Gonzalez2024-02-05Our experience with DSI has been wonderful. Ben stayed with me for over a year working on getting us onboard with our new equipment, and now that we are all hooked up David has continued with their personalized service. Would recommend DSI 100%!

Avenelle Gonzalez2024-02-05Our experience with DSI has been wonderful. Ben stayed with me for over a year working on getting us onboard with our new equipment, and now that we are all hooked up David has continued with their personalized service. Would recommend DSI 100%! Rosy Lopez2024-01-31Great Custumer Services and very friendly. And most important they help me with what I reallly need it!. Thank you Andrew Coca and David Martinez.

Rosy Lopez2024-01-31Great Custumer Services and very friendly. And most important they help me with what I reallly need it!. Thank you Andrew Coca and David Martinez. Stallion Santiago Vigil2024-01-25Their customer service and tech service has been excellent. Everyone we come in contact with, whether it be over the phone, or in person are very courteous and make sure they handle your needs.

Stallion Santiago Vigil2024-01-25Their customer service and tech service has been excellent. Everyone we come in contact with, whether it be over the phone, or in person are very courteous and make sure they handle your needs. Shanna Hale2024-01-25Our Company was with a competitor for many years and just recently signed a lease with DSI. It was a smooth and friendly transition. We are a month into the lease and they have lived up to their promises to us. We appreciate their team and their dedication to making sure that we have what we need in the copier. Thank you!

Shanna Hale2024-01-25Our Company was with a competitor for many years and just recently signed a lease with DSI. It was a smooth and friendly transition. We are a month into the lease and they have lived up to their promises to us. We appreciate their team and their dedication to making sure that we have what we need in the copier. Thank you! Kristy Meyer2023-12-27The school where I work has been using DSI for several years now and I can't recommend the business of DSI or Alex Small (service technician) himself enough. Every person that I have ever spoken to at DSI is prompt, courteous, knowledgeable, offers tips and tricks to keep our printers running smoothly, and lets me know that my business is important to them. When Alex comes to repair a part, he always lets me know if another part will need to be replaced soon and usually offers to replace it while he is already there to avoid a future service charge. DSI is customer service oriented and always comes through for us. Well done, DSI! Well done.

Kristy Meyer2023-12-27The school where I work has been using DSI for several years now and I can't recommend the business of DSI or Alex Small (service technician) himself enough. Every person that I have ever spoken to at DSI is prompt, courteous, knowledgeable, offers tips and tricks to keep our printers running smoothly, and lets me know that my business is important to them. When Alex comes to repair a part, he always lets me know if another part will need to be replaced soon and usually offers to replace it while he is already there to avoid a future service charge. DSI is customer service oriented and always comes through for us. Well done, DSI! Well done. Giancarlo Daniel Chavez-Lambert2023-12-21Great service and Alex is awesome! Professional and very knowledgeable.

Giancarlo Daniel Chavez-Lambert2023-12-21Great service and Alex is awesome! Professional and very knowledgeable. Robert Wichmann2023-12-21

Robert Wichmann2023-12-21

Get Started

Before making any recommendations, we listen to learn and understand each client’s unique environment.

So, whether it’s business automation, process or workflow improvements, document management, information technology, or imaging equipment needs, we can help you with our customized office technology & IT services in New Mexico!

News and Articles

Efficient Office Tech & Printer Setup: Key Tips

In the fast-paced world of modern business, efficiency is key to staying competitive and achieving success. While innovative technologies like cloud-based computing and unified communications

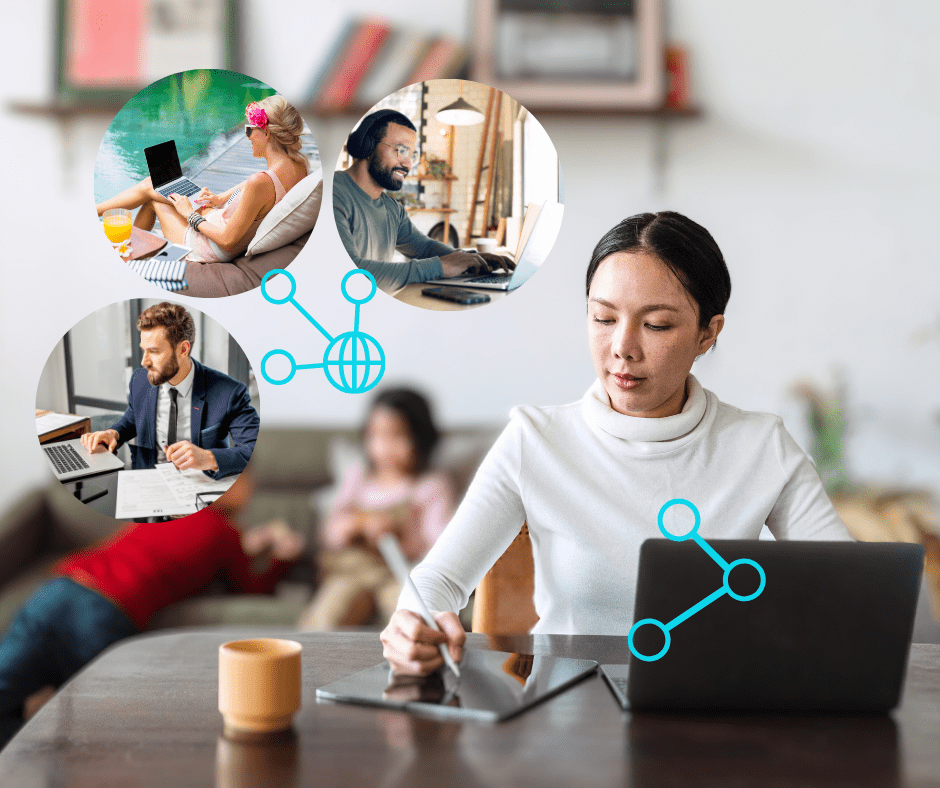

The Advantages of Using VoIP in a Remote Working Environment

In today’s dynamic work landscape, the shift towards remote work has become increasingly prevalent, necessitating innovative solutions to facilitate seamless communication and collaboration among dispersed